Written by Joe Armstrong, Content Specialist, Marketing, Downtown Main Library

You'll feel like a million bucks - and be on your way to earning much more than that - when using a new database available for free to all Cincinnati & Hamilton County Library cardholders.

Whether you're a seasoned investor or just starting your financial journey, Weiss Financial Ratings helps you protect your finances, invest wisely, grow your wealth, and learn more about your finances. Let's dive into the key features and benefits of this powerful resource.

Financial Literacy Tools

Learn everything from how to open a checking account to maximizing a diversified investment portfolio using Weiss Financial Ratings' Financial Literacy Tools. These easy-to-read, step-by-step guides are packed with accurate, unbiased information and recommendations. Here are just some of the tools available for free for all CHPL cardholders:

- Making a Budget

- Buying a Car

- Saving for College

- Managing Debt

- Buying a Home

- Saving for Your Child's Education

- All About Investment Fees

- Investment Tax Consequences

A number of free, helpful financial planning tools designed to enhance your decision-making process are also available to download. For example, their Homeowners Insurance Quote Comparison Worksheet is a great way to stay organized as you compare the premium quotes from different insurance companies.

A number of free, helpful financial planning tools designed to enhance your decision-making process are also available to download. For example, their Homeowners Insurance Quote Comparison Worksheet is a great way to stay organized as you compare the premium quotes from different insurance companies.

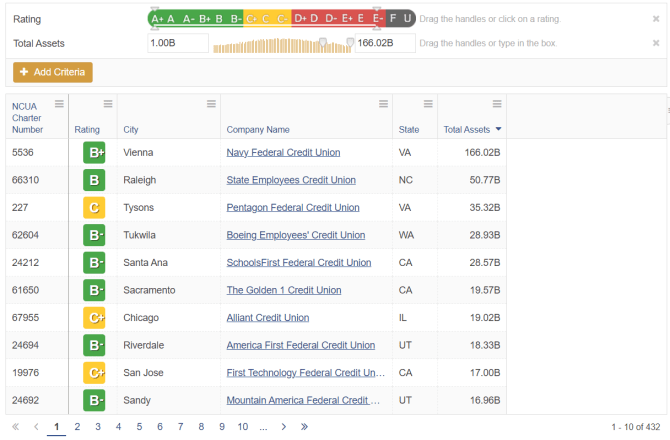

Safety Ratings

Weiss Financial Ratings' Safety Ratings allow you to make informed choices when selecting financial institutions for your savings and investments. From A+ (excellent) to F (failed), the ratings are easy to understand and can be used for banks, credit unions, and insurance companies.

Get the best options for your situation using their screener tools, where you can add criteria such as geographic location, stability index, total assets, and contact information.

Build Your Own Medigap Planner

For those approaching retirement age, navigating the world of Medicare can be overwhelming. Thankfully, the Weiss Financial Ratings tool offers valuable information about Medigap plans. These plans fill the gaps in Medicare coverage, ensuring you get the healthcare you need without breaking the bank.

With your Personalized Medicare Supplement Insurance Planner, you get step-by-step guidance on how to select a Medigap insurance plan, which plans are right for you, and which insurance company has the lowest rates.

By simply entering your name, age, gender, and zip code, you get immediate access to your own 80+ page, information-packed Buyer’s Guide & Cost Calculator, customized just for you, including how to:

- Learn What Medicare Does and Does Not Cover

- Find Out Your Options

- Pick a Medigap Plan

- View Rates for each Plan & Insurer, so you can be sure you're getting the best rate

- Locate the Best Insurers

- Find an Authorized Agent

We understand that tricky topics like healthcare, investments, and finance can be overwhelming. While we won't be able to offer financial advice or guidance, our reference staff is here to help you navigate the database and find the information you need to make a decision.

Weiss Financial Ratings is free to use with your library card. Start exploring Weiss Financial Ratings on our website.

Add a comment to: Learn How to Make a Budget, Research Stocks, and More with New Database